INTRODUCTION

There is a beacon of hope – bad credit credit cards – in the relentless waves of uncertainty. Bad credit credit cards is the financial tools offer a lifeline to those struggling to rebuild their creditworthiness and navigate back to calmer financial waters. It’s a situation that millions of us find themselves in, often through no fault of their own. Whether it’s due to unexpected medical bills, job loss, or simply financial missteps in the past, bad credit can feel like an insurmountable barrier.

In this guide, we’ll explore what bad credit credit cards are, how they work, and how they can be a catalyst for financial empowerment and resilience.

What is Bad Credit Credit Cards

Bad credit credit cards are financial products specifically designed for individuals with poor or limited credit histories. These credit cards cater to people who may have struggled with past financial difficulties, such as late payments, defaults, or bankruptcies, which have negatively impacted their credit scores.

Unlike traditional credit cards that typically require a good credit history for approval, bad credit credit cards are more accessible. They are often available to individuals with lower credit scores or those who have been denied by other lenders. However, bad credit credit cards may come with certain limitations and higher fees compared to standard credit cards.

The primary purpose of bad credit credit cards is to provide a means for individuals to rebuild or establish their creditworthiness. By using these cards responsibly and making timely payments, cardholders can demonstrate financial responsibility and gradually improve their credit scores over time.

What is a secured credit card?

A secured credit card is a type of credit card that requires a cash deposit to be made upfront as collateral. This deposit acts as security for the credit card issuer in case the cardholder defaults on payments. The credit limit of the card is usually decided by the bank by the amount of the deposit made.

Secured credit cards are typically used by individuals who have poor credit history, or those who are looking to rebuild their credit. By using a secured credit card responsibly—making on time payments and keeping the outstanding balances lower (about 20-30%) of the offered limit —the cardholder can improve their credit score over time.

Features of bad credit credit cards may include:

- Higher interest rates: Bad credit credit cards often come with higher annual percentage rates (APRs) compared to standard credit cards. This is because individuals with poor credit are considered higher risk borrowers by lenders.

- Lower credit limits: Cardholders may be issued lower credit limits initially to mitigate the risk for the issuer. However, as they demonstrate responsible credit usage, some card issuers may offer credit limit increases over time.

- Fees: Bad credit credit cards may come with various fees, such as annual fees, monthly maintenance fees, or application fees. These fees can add to the overall cost of using the card and should be carefully considered before applying.

- Reporting to credit bureaus: Responsible usage of a bad credit credit card can help individuals rebuild their credit history. Many card issuers report card activity to the major credit bureaus (Experian, Equifax, and TransUnion), which can positively impact credit scores when payments are made on time.

- Limited rewards or perks: Bad credit credit cards may offer fewer rewards, cashback incentives, or benefits compared to standard credit cards. However, some cards may still provide basic rewards programs or features tailored to individuals with poor credit.

Overall, bad credit credit cards serve as a tool for individuals to rebuild their credit standing and regain financial stability. While they may come with higher costs and limitations, responsible usage can help individuals gradually improve their creditworthiness and access better financial opportunities in the future.

Imagine standing on the shore, watching the waves crash against the rocks, feeling powerless against the forces of nature. That’s how bad credit can feel – like being caught in a financial storm with no way out. Bad credit is often the result of missed payments, defaults, or other financial hardships that leave a mark on our credit reports.

You know, In the world of finance, our credit scores act as a measure of our financial health. They determine our ability to borrow money, the interest rates we’re offered, and even our housing and employment opportunities. When our credit scores are low, traditional lenders may turn us away, leaving us feeling stranded and hopeless.

Enter Bad Credit Credit Cards:

Just when it seems like there’s no way forward, bad credit credit cards offer a glimmer of hope. Unlike traditional credit cards, which often require a pristine credit history, bad credit credit cards are more forgiving. They are designed specifically for individuals with less-than-perfect credit and offer a pathway to access credit and rebuild financial credibility.

But how do bad credit credit cards work? These cards may have lower credit limits, higher interest rates, and sometimes come with fees. However, they serve a crucial purpose for those looking to improve their credit scores. By using these cards responsibly – making timely payments, keeping balances low, and avoiding unnecessary fees – individuals can demonstrate their creditworthiness and begin to rebuild trust with creditors.

The Emotional Impact:

Navigating the world of bad credit can take a toll on our emotional well-being. It’s easy to feel overwhelmed, ashamed, or judged by past financial mistakes. The stigma surrounding bad credit can weigh heavily on our shoulders, making it difficult to see a way forward.

But it’s essential to remember that bad credit does not define us as individuals. It’s merely a chapter in our financial journey – one that we have the power to rewrite. By approaching the process with compassion, self-forgiveness, and determination, we can begin to reclaim our financial independence and rebuild our lives.

Finding the Right Card Provider :

Just as every sailor needs a reliable compass, finding the right bad credit credit card is essential. With so many options available, it’s crucial to compare terms, fees, and benefits carefully. Look for cards that report to all three major credit bureaus, offer manageable fees, and provide tools for tracking and managing finances.

Consider how the card aligns with your financial goals and needs. Some cards offer rewards or cashback incentives, while others focus solely on rebuilding credit. Choose a card that not only meets your immediate needs but also supports your long-term financial aspirations.

In the USA, several banks and financial institutions offer bad credit credit cards to individuals looking to rebuild their credit. Here are some of the prominent ones along with their official websites where you can apply:

I. Capital One Credit Card:

Capital One offers several credit card options for individuals with less-than-perfect credit, including the Capital One Platinum Secured Credit Card and the Capital One QuicksilverOne Cash Rewards Credit Card. Apply Official Website: Capital One Credit Cards

BENEFITS OF CAPITALONE SECURED CREDIT

CARDS:

Account Management

Eno, your Capital One assistant 1

Eno keeps an eye on your accounts 24/7 and sends alerts when something’s up. You can ask questions about your account and receive instant answers. Learn More.

Automatic Credit Line Reviews

Be automatically considered for a higher credit line in as little as 6 months. Available with these cards that can help you build credit with responsible use.

Proactive Account Alerts

Receive an alert if Capital One detects a potential mistake or unexpected charge. You can also set up personalized emails or text reminders to help you stay on top of your account. Set up my alerts.Personalized PaymentPick your own monthly due date and payment method—check, online or at a local branch—all with no fee.AutoPaySet up AutoPay for your account and your payments will be made automatically every month.Authorized UsersAdd an authorized user to your account—they’ll share your line of credit and benefits but have their own card and card number so you can see who spent what, on one statement. Learn more.Balance TransferTransfer your higher-rate balances onto a Capital One card. Learn more about balance transfers.24/7 Customer ServiceHelpful customer service representatives are available to assist you 24 hours a day.$0 Fraud LiabilityIf your card is lost or stolen, you will not be responsible for unauthorized charges.Virtual Card NumbersKeep your real card number to yourself and shop online more securely with virtual card numbers. Learn more about how to generate alias numbers right from a checkout page.Card Lock 2Effortlessly lock your card with a few taps if it has been misplaced, lost or stolen.Security AlertsGet notified via text, email and phone if Capital One notices potential suspicious activity on your account. Add your mobile number.Capital One Mobile AppManage your account anywhere, anytime. Pay your bill, view your balance and transactions. Learn more about our mobile app.Eno, your Capital One assistantEno keeps an eye on your accounts 24/7, sends alerts when something’s up and is always ready to answer questions—so you can keep moving. Learn more about Eno.CreditWise from Capital OneMonitor your credit with CreditWise. It’s free for everyone—whether or not you have a Capital One credit card—and it won’t hurt your score. Learn more about the CreditWise app.Sureswipe / Touch IDSign in to Capital One Mobile quickly and securely with your fingerprint or customized pattern.Credit Card Rewards9 BenefitsUnlimited Rewards, No ExpirationsThere’s no limit to how much cash back or travel miles you can earn with Capital One rewards credit cards. Plus, your rewards won’t expire for the life of the account.Travel RewardsEarn travel miles on every purchase. Book through any site or service and redeem for any flight, car rentals, hotels, ride-sharing apps, cruises and more. Compare travel rewards cardsCash RewardsEarn cash back on every purchase, every day. Redeem for any amount, and rewards won’t expire for the life of the account. Compare cash back cardsStatement Credit 3Redeem your rewards to lower your account balance.Get Gift Cards 4Redeem rewards for gift cards with your favorite merchants.Transfer Your Miles 5With our travel rewards cards, you may be able to transfer miles to one of our 10+ travel partners.Easy to RedeemSign into your account or use Capital One’s mobile banking app to easily view redemption options.Shop with Rewards at Amazon.comPay for your purchases at Amazon.com using your Capital One rewards. Learn more about how to use your rewards at Amazon.Redeem Rewards with PayPalUse your Capital One rewards on eligible purchases at millions of online stores. Learn more about using rewards with PayPal.Travel and Retail Benefits8 BenefitsEmergency Card ReplacementIf your credit card is lost or stolen, you can get an emergency replacement card.No Foreign Transaction FeesYou won’t pay a transaction fee when making a purchase outside of the United States. Learn more about foreign transaction fees.Capital One OffersCardholders have exclusive access to earn statement credits by shopping online at thousands of retailers, like Adidas, Macy’s and moreCapital One ShoppingCapital One Shopping is an online shopping tool that automatically applies available coupon codes to your order. Learn more about Capital One Shopping.Capital One TravelEarn extra rewards when you book through Capital One Travel using eligible miles cards. Plus, get our best prices on thousands of flights, hotels and rental cars. Explore Capital One Travel.Capital One LoungeRelax and recharge away from the airport crowds with luxurious amenities and fresh, local food and beverage options. Explore the Capital One Lounge.Partner Lounge NetworkEligible travel rewards cardholders can elevate their travel experience with complimentary visits to one of the global lounge locations in our Partner Lounge Network. Explore the Partner Lounge Network.50% off Handcrafted BeveragesCapital One cardholders enjoy 50% off all handcrafted beverages everyday at any Capital One Café nationwide. Find your Café. 7Premier Access2 BenefitsCapital One DiningMake your next meal even more memorable with access to cardholder-only reservations at award-winning restaurants and tickets to curated culinary events. Explore dining benefits.Capital One EntertainmentEnjoy access to can’t miss events across music, sports and dining with exclusive pre-sales, tickets, suite experiences and more. Explore entertainment Special Offers1 BenefitReceive Up to $100 Credit on Global Entry or TSA PreCheck® 6

II. Discover Credit Card:

Discover offers the Discover it Secured Credit Card, which is designed to help individuals build or rebuild their credit

- Official Website: Discover Credit Cards

BENEFITS OF DISCOVER SECURED CREDIT CARDS:

Secured Credit Card

28.24% standard variable purchase APR. Intro Balance Transfer APR is 10.99% for 6 months from date of first transfer subject to availability of offer then standard purchase APR applies. Cash APR: 29.99% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: 3% Intro fee on balances transferred as per availability of offer and up to 5% fee for future balance transfers will apply. Annual Fee: None. Rates as of February 29, 2024. We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

1. Social Security Number Alerts: Discover® Identity Alerts (Alerts) are offered by Discover Bank at no cost, are available only online, and do not impact your credit score. The Alerts currently provide: (a) daily monitoring of your Experian® credit report and an alert when a new inquiry or account is listed on your report; (b) daily monitoring of thousands of Dark Web sites known for revealing personal information and an alert if your Social Security Number is found on such a website. Alerts are only provided to, Primary cardmembers that agree to receive them online and whose accounts are open, in good standing, have a Social Security Number, and an email address on file. This benefit may change or end in the future if there is no offer. Discover Bank is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. To see a list of Frequently Asked Questions, visit discover.com/freealerts.

2. Online Privacy Protection: Online Privacy Protection is offered by Discover Bank at no cost and only available in the mobile app. About every 90 days we will scan at least 10 people-search sites for your online personal information and help you submit opt-out requests. Types of personal information found on these sites will vary.

3. $0 Fraud Liability: An “unauthorized purchase” is a purchase where you have not given access to your card information to another person or a merchant for one-time or repeated charges. Please use reasonable care to protect your card and do not share it with employees, relatives, or friends. Learn more at Discover.com/fraudFAQ.

4. Freeze your card: When you freeze your account, Discover will not authorize new purchases, cash advances or balance transfers. However, some activity will continue, including merchant-indicated recurring bill payment, as well as returns, credits, dispute adjustments, delayed authorizations (such as some transit purchases), payments, Discover protection product fees, other account fees, interest, rewards redemptions, and certain other exempted transactions.

5. 2% Cashback: You can earn a full 2% Cashback Bonus® on your first $1000 in combined purchases at Gas Stations (stand-alone), and Restaurants each calendar quarter. Calendar quarters begin January 1, April 1, July 1, and October 1. Purchases at Gas Stations and Restaurants over the quarterly cap, and all other purchases, earn 1% cash back. Gas Station purchases include those made at merchants classified as places that sell automotive gasoline that can be bought at the pump or inside the station, and some public electric vehicle charging stations. Gas Stations affiliated with supermarkets, supercenters, and wholesale clubs may not be eligible. Restaurant purchases include those made at merchants classified as full-service restaurants, cafes, cafeterias, fast-food locations, and restaurant delivery services. Purchases must be made with merchants in the U.S. To qualify for 2%, the purchase transaction date must be before or on the last day of the offer or promotion. For online purchases, the transaction date from the merchant may be the date when the item ships.

Rewards are added to your account within two billing periods. Even if a purchase appears to fit in a 2% category, the merchant may not have a merchant category code (MCC) in that category. Merchants and payment processors are assigned an MCC based on their typical products and services. Discover Card does not assign MCCs to merchants. Certain third-party payment accounts and digital wallet transactions may not earn 2% if the technology does not provide sufficient transaction details or a qualifying MCC. Learn more at Discover.com/digitalwallets. See Cashback Bonus Program Terms and Conditions for more information.

6. Rewards never expire. Discover reserve the right to determine the method to disburse your rewards balance. We will credit your Account or send you a check with your rewards balance if your Account is closed or if you have not used it within 18 months.

7. Use Rewards at Amazon.com: For complete details on how to Pay with Rewards at Amazon.com see Amazon.com/DiscoverRewards. Amazon is not a sponsor of this promotion. Amazon, the Amazon.com logo, the smile logo and all related marks are trademarks of Amazon.com, Inc. or its affiliates.

8. Use Rewards with PayPal: For complete details on how to Pay with Rewards with PayPal see PayPal.com/Discover. Pay with Rewards will be available for eligible credit cards on eligible purchases or can be donated to support a charitable cause with PayPal Giving Fund. To learn more about Pay with Rewards, see terms and conditions. All reward redemptions are subject to Discover’s reward program terms.

9. Service: You can reach a live agent anytime by calling 1-800-347-2683. Certain specialized customer service agents may not be available 24/7.

10. FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based on data from TransUnion® and may be different from other credit scores and other credit information provided by different bureaus. This information is intended for and only provided to Primary account holders who have an available score. See Discover.com/FICO about the availability of your score. Your score, key factors and other credit information are available on Discover.com and cardmembers are also provided a score on statements. Customers will see up to a year of recent scores online. Discover and other lenders may use different inputs, such as FICO® Credit Scores, other credit scores and more information in credit decisions. This benefit may change or end in the future. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

11. Recurring Charges Dashboard: We identify card not present (or online) transactions as a “Recurring Charge” in your Dashboard when merchants have marked the transactions as recurring, or we have determined there is a clear pattern of recurrence. It is possible that some recurring charges may not appear in your dashboard.

12. Click to Pay: The Click to Pay icon, consisting of a pentagon design oriented on its side with a stylized depiction of a fast forward symbol on the right, formed by a continuous line, is a trademark owned by and used with permission of EMVCo, LLC.

EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.

13. Digital Wallet: For a list of compatible Apple Pay devices, see https://support.apple.com/en-us/HT208531. Apple, the Apple logo, Apple Pay, Apple Watch, iPad, iPhone, Mac are trademarks of Apple Inc., registered in the U.S. and other countries. Google Pay, Google Play and the Google Play logo are trademarks of Google LLC. Samsung Pay is a trademark of Samsung Electronics Co., Ltd. Use only in accordance with law. Samsung Pay is available on select Samsung devices.

14. Amazon: Amazon is not a sponsor of this promotion. Amazon, the Amazon.com logo, the smile logo and all related marks are trademarks of Amazon.com, Inc. or its affiliates.

15. PayPal: PayPal, the PayPal logo are trademarks of PayPal or its Affiliates.

III. First Progress Credit Card:

First Progress offers secured credit cards that are specifically designed for individuals with bad or no credit history.

- Official Website: First Progress Credit Cards

BENEFITS OF FIRST PROGRESS CARDS:

- Earn 1% Cash Back Rewards on payments made to your First Progress Secured credit card account.

- Reports to all 3 major credit bureaus

- The First Progress Secured Credit Card is accepted wherever Mastercard® is accepted, online and worldwide!

- Pay 6-months-on-time and apply to get a second credit card in your wallet!

- Manage your statements, transactions and rewards on-the-go with the First Progress Card Mobile App!

- See your VantageScore®+. Easy, Free Access to Credit Education in the First Progress Card Mobile App!

IV. OpenSky:

OpenSky offers secured credit cards with no credit check required, making them accessible to individuals with poor credit.

Official Website: OpenSky Secured Visa Credit Card

BENEFITS OF OPEN SKY CREDIT CARD

For most updated benefits, pls visit the OpenSky website

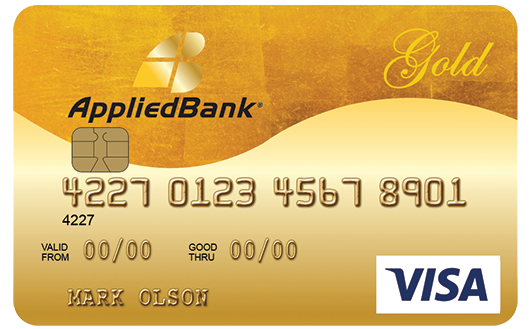

V. Applied Bank

Applied Bank offers secured credit cards designed to help individuals establish or rebuild their credit.

Official Website: Applied Bank Secured Visa Gold Preferred Credit Card

Get Approved† for the Credit You Need in Less Than 60 Seconds with the Applied Bank® Secured Visa® Card!

Approval is GUARANTEED – No Credit Check or Minimum Credit Score Required†

A REAL Visa® Credit Card with Automatic Reporting to All Three National Credit Bureaus

- Low Fixed Interest Rate Low 9.99% fixed APR with NO Application Fee and NO Penalty Rate

- Refundable Security Deposit

Activate Today with a refundable Security Deposit, Minimum $200, Maximum $1,000. Increase your credit limit up to $5,000 by adding additional deposits any time after your application has been approved.

- Online & Mobile Banking

Access your account online and via your mobile device from almost anywhere. It’s easy, fast and secure! Pay your credit card bill, check your balance, monitor your credit availability and much more.

- Account Security

The Applied Bank® Secured Visa® Card has embedded chip technology for enhanced security and protection when making purchases at chip-enabled merchant terminals.

For more benefits, please visit Applied Bank Website.

VI. Bank of America:

Bank of America offers the BankAmericard Secured Credit Card, which is designed for individuals looking to establish or rebuild their credit.

Official Website: Bank of America Credit Cards

BENEFITS OF BANK OF AMERICA SECURED CREDIT CARD

Help build your credit

A secured credit card designed to help establish, strengthen or rebuild credit

A minimum security deposit of $200 (maximum of $5,000) is required to open this account.

Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established.

FICO® Score

You can access your FICO® Score updated monthly for free, within your Mobile Banking app or in Online Banking. Opt-in to receive your score, the key factors affecting your score, and other information that can help you keep your credit healthy.

Deposit

We’ll periodically review your account and, based on your overall credit history (including your account and overall relationship with us, and other credit cards and loans), you may qualify to have your security deposit returned. Not all customers will qualify.

2023 Certified Financial Health Support

Bank of America – Outstanding Customer Satisfaction with Financial Health Support – Banking & Payments, 2 years in a row

Learn more about credit

Access to credit education on topics like using credit cards responsibly, budgeting and more

Secured card products are not eligible for a new account bonus offer, like a statement credit, and introductory APRs are not available.

J.D. Power 2023 Financial Health Support CertificationSM is based on exceeding customer experience benchmarks using client surveys and a best practices verification. For more information, visit jdpower.com/awards.

Interest Rates & Fees Summary†

Introductory APR

Standard APR

variable

Annual Fee

Balance Transfer Fee

4% of each transaction†

†Please see Terms and Conditions for rate, fee and other cost information, as well as an explanation of payment allocation. All terms may be subject to change.

Note: minimum payments are applied to lower-interest balances first. Additional payments are applied to higher-interest balances first.

Security & Features

Stay Protected

We block potential fraud if abnormal patterns are detected and let you know if we suspect fraudulent activity. Plus, you always get a $0 Liability Guarantee for fraudulent transactions. Footnote[1] Learn more at the Security Center Opens in a new window

Contactless Chip Technology

Simply tap to pay where you see the Contactless Symbol. You can make purchases quickly, easily and securely at millions of locations. Learn more about Contactless Chip Technology opens in a new window

Balance Connect® for overdraft protection

An optional service to help prevent declined purchases, returned checks or other overdrafts when you link your eligible Bank of America® checking account to your credit card. No transfer fees. Other fees may apply. Footnote[2]

Paperless Statement Option

Opt for paperless credit card statements and increase account security while reducing paper consumption.

Digital Wallet Technology

Discover more ways to pay by adding your Bank of America® credit card to your mobile device then shop in-store or in-app using Apple Pay®, Google Pay™ or Samsung Pay. Learn more about Digital Wallets Technology opens in a new window

Online & Mobile Banking

Access to our award-winning Online and Mobile Banking. Bank on the go from almost anywhere quickly and securely. Pay your credit card bill online, transfer funds, check available credit and more. Footnote[3]

Account Alerts

Stay on top of your balances and due dates. Choose from several types of customer email or text alerts and let your phone tell you when payments are due and paid. Footnote[4]

FICO® Score

Now, when you opt-in you can access your FICO® Score updated monthly for free, within your Mobile Banking app or in Online Banking.Footnote[5] Learn More

- $0 Liability Guarantee. The $0 Liability Guarantee covers fraudulent transactions made by others using your account. To be covered, don’t share personal or account information with anyone. Claims may only be filed by the accountholder against posted and settled transactions subject to dollar limits and verification, including providing requested information supporting fraudulent use claim.

- Overdraft Protection. Transfers through our Balance Connect® for overdraft protection service to your eligible Bank of America deposit account from your credit card account will be Bank Cash Advances under your Credit Card Agreement. Transfers will be subject to the terms of both your Credit Card Agreement and the account agreement(s) and disclosures governing your Bank of America deposit account. Overdraft protection transfers may not be available for up to 14 days from account opening. If you link your Bank of America deposit account to your credit card for Overdraft Protection, we will automatically transfer funds from your credit card account to cover overdrafts on your deposit account, as long as the portion of credit available for cash on your credit card account is sufficient and you are not in default under your Credit Card Agreement. Overdraft protection transfers from a linked credit card will be made up to the amount required to cover the overdraft and any applicable transfer fee to the covered account. While there is no transfer fee when you use Balance Connect® for overdraft protection, other fees may apply. The Overdraft Protection Cash Advance will accrue interest at the APR stated in your Credit Card Agreement. Overdraft protection transfers incur interest charges from the transaction date. If the portion of credit available for cash on your credit card account is insufficient to cover the amount required by the overdraft (in the multiple of funds stated above), we may advance the funds even if it causes your credit card account to exceed your Cash Credit Line. Please see your Credit Card Agreement for additional details.

- Mobile Banking. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

- Alerts. You may elect to receive alerts via text or email. Bank of America does not charge for this service but your mobile carrier’s message and data rates may apply. Delivery of alerts may be affected or delayed by your mobile carrier’s coverage.

- FICO® Score Program. The FICO® Score Program is for educational purposes and for your non-commercial, personal use. This benefit is available only for primary cardholders with an open and active consumer credit card account who have a FICO® Score available. The feature is accessible through Online Banking, the Mobile website, and the Mobile Banking app for iPhone and Android devices. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Data connection required. Wireless carrier fees may apply.

VII. Credit One Bank:

Official Website: Credit One Bank Credit Cards

Please note that availability and terms may vary based on individual credit profiles and other factors. It’s essential to review the specific terms and conditions of each card before applying to ensure it meets your needs and financial goals. Additionally, it’s recommended to use these cards responsibly to rebuild your credit gradually.

Merits of Bad Credit Credit Cards:

- Accessibility: Bad credit credit cards are more accessible than traditional credit cards for individuals with poor or limited credit histories. They provide an opportunity for those who may have been denied by other lenders to access credit and begin rebuilding their credit profiles.

- Credit Building: One of the primary benefits of bad credit credit cards is their potential to help individuals rebuild their credit scores. By using these cards responsibly and making timely payments, cardholders can demonstrate creditworthiness and improve their credit standing over time.

- Financial Flexibility: Having a bad credit credit card can provide a sense of financial flexibility, allowing individuals to make purchases and manage expenses, even if they don’t have access to other forms of credit.

- Educational Tools: Some bad credit credit cards come with educational resources and tools to help cardholders manage their finances more effectively. These resources may include budgeting tools, credit score tracking, and financial literacy materials, which can be valuable for individuals looking to improve their financial skills.

Demerits of Bad Credit Credit Cards:

- Higher Interest Rates: Bad credit credit cards typically come with higher interest rates compared to traditional credit cards. This is because individuals with poor credit are considered higher risk borrowers by lenders. High-interest rates can result in increased costs for cardholders, especially if they carry balances from month to month.

- Fees: Many bad credit credit cards come with various fees, such as annual fees, monthly maintenance fees, and application fees. These fees can add to the overall cost of using the card and may be substantial, particularly for individuals with limited financial resources.

- Lower Credit Limits: Cardholders may be issued lower credit limits initially when they first obtain a bad credit credit card. While credit limits may increase over time with responsible credit usage, lower credit limits can restrict purchasing power and may not meet the needs of individuals with larger expenses.

- Limited Rewards and Benefits: Bad credit credit cards often offer fewer rewards, cashback incentives, and benefits compared to traditional credit cards. Cardholders may miss out on perks such as travel rewards, purchase protection, and extended warranties that are typically available with higher-tier credit cards.

- Potential for Debt Accumulation: Without careful budgeting and financial discipline, bad credit credit cards can lead to debt accumulation. High-interest rates and fees can exacerbate debt problems, particularly for individuals already facing financial challenges.

WHAT ARE THE DOCUMENTS REQUIRD TO APPLY BAD CREDIT CREDIT CARDS:

The documents required to apply for a bad credit credit card may vary depending on the issuer and the specific card you’re applying for. However, here are some common documents and information that you may need to provide:

- Personal Identification: You’ll typically need to provide a valid form of identification, such as a driver’s license, state ID card, or passport. This helps the issuer verify your identity.

- Social Security Number (SSN): You’ll likely need to provide your SSN as part of the application process. This is used to verify your identity and assess your creditworthiness.

- Proof of Income: Some issuers may require proof of income to ensure that you have the means to make payments on the credit card. This could include recent pay stubs, tax returns, or bank statements.

- Employment Information: You may need to provide details about your current employment status, including your employer’s name, address, and contact information.

- Contact Information: You’ll need to provide your current address, phone number, and email address so that the issuer can contact you regarding your application.

- Previous Address History: Some issuers may ask for your previous address history to verify your identity and assess your creditworthiness.

- Other Financial Information: Depending on the issuer’s requirements, you may need to provide additional financial information, such as details about your assets, liabilities, or existing debts.

- Security Deposit (for Secured Cards): If you’re applying for a secured credit card, you may need to provide a security deposit to open the account. The amount of the deposit may vary depending on the issuer and the credit limit you’re seeking.

WHAT ARE THE CREDIT CARDS OFFERING WITHOUT SECURITY DEPOSIT OR COLLATERAL.

Several banks and financial institutions offer bad credit credit cards without security deposits, allowing individuals to access credit without having to provide collateral. Here are some options:

- Capital One: Capital One offers several unsecured credit card options for individuals with less-than-perfect credit, including the Capital One Platinum Credit Card and the Capital One QuicksilverOne Cash Rewards Credit Card. These cards typically do not require a security deposit.

Official Website: Capital One Credit Cards

- Credit One Bank: Credit One Bank offers unsecured credit cards designed for individuals with poor credit, including the Credit One Bank Platinum Visa. While some cards from Credit One Bank may require a security deposit, others may be available without one, depending on your credit profile.

Official Website: Credit One Bank Credit Cards

- Indigo® Mastercard® for Less than Perfect Credit: The Indigo® Mastercard® is designed for individuals with less-than-perfect credit and may be available without a security deposit. This card offers pre-qualification with no impact on your credit score.

Official Website: Indigo® Mastercard®

- Milestone® Gold Mastercard®: The Milestone® Gold Mastercard® is another option for individuals with poor credit. This card is unsecured and may be available without a security deposit, depending on your creditworthiness.

Official Website: Milestone® Gold Mastercard®

- First Premier Bank Credit Cards: First Premier Bank offers unsecured credit cards designed for individuals with poor credit. These cards may be available without a security deposit, depending on your credit profile.

Official Website: First Premier Bank Credit Cards

WHAT ARE THE AGE CRITERIA FOR APPLYING BAD CREDIT CREDIT CARDS

The age criteria to apply for bad credit credit cards in the USA typically align with the legal age of majority, which is 18 years old in most states. However, some credit card issuers may have specific age requirements or restrictions for their products. Here are some key points regarding the age criteria for applying for bad credit credit cards:

- Minimum Age: Most credit card issuers require applicants to be at least 18 years old to apply for a credit card. This is the legal age of majority in most states, meaning individuals are considered adults and can enter into legally binding contracts.

- Parental Consent: In some cases, individuals under the age of 18 may be able to obtain a credit card with parental consent. This typically involves a parent or guardian co-signing on the credit card application and assuming responsibility for the account.

- Age Restrictions: Some credit card issuers may have specific age restrictions for their products. For example, certain credit cards may be targeted towards college students or young adults and may have minimum age requirements higher than 18.

- Secured Credit Cards: Secured credit cards, which require a security deposit to open the account, may have more lenient age criteria compared to traditional unsecured credit cards. However, individuals still need to meet the issuer’s minimum age requirements to apply.

- Authorized Users: In some cases, individuals who are not old enough to apply for their own credit card may be able to become authorized users on someone else’s credit card account. Authorized users typically receive their own card linked to the primary cardholder’s account but do not have legal responsibility for the debt.

The Journey Forward:

As we set sail on the journey of rebuilding credit, it’s essential to approach the process with patience, resilience, and determination. There may be storms ahead – unexpected expenses, job loss, or other challenges – but armed with the right tools and mindset, we can weather any adversity.

Bad credit credit cards are more than just financial tools; they’re symbols of hope and opportunity. They remind us that no matter how rough the seas may seem, there’s always a path forward toward brighter shores. So let’s navigate with compassion, empathy, and unwavering determination, knowing that with each step forward, we’re one step closer to reclaiming our financial independence and building a brighter future.